EMPOWER YOURSELF, MONETIZE YOU, MANAGE YOUR FINANCES

Self empowerment begins with doing everything in your power to ensure you live your best life possible – doing the things you enjoy. And a huge part of being empowered is being able to care for yourself financially. In fact, without the proper financial backing, it is impossible to live a decent life – let alone your desired lifestyle. Empower yourself! Discover your What and determine your Why, so you can map and execute your How.

EMPOWER YOURSELF

YOU and only YOU are in charge of YOU! Know and define yourself! Don't leave it to others to tell you who you are. Know what YOU stand for, so you do not fall for anything. Know what YOU want, so you can align yourself to get what you want, and spend your time living the way you want and not simply exist and be blown to and fro.

Operate in the "I AM" "I CAN" "I WILL for me" and let nothing keep you off track. You may get off track, that's life, but don't dwell there. Commit to yourself to be the best YOU YOU can be, and honor your commitment to yourself.

Stand in YOUR truth of who YOU are, what YOU stand for, and what YOU want - BE, DO, GET. Equip yourself with the right tools to get you wherever you want to be, and doing whatever you want to do, living the lifestyle you want.

This Lifestyle Designing Workbook was created with this very important task in mind.

Download your FREE copy and get ready to start or continue on your self empowerment journey with tools to help you do just that.

Cheers to your empowerment 🍷

Financial Independence is one of the most important aspect of self empowerment. There is barely anything that anyone can do without money being involved, and so, monetization is positioned at the forefront of my coaching experience.

I've developed My Blooming Biz Academy to help facilitate women who are at various stages of securing their financial independence. You can learn more about My Blooming Biz Academy here.

It may also suit you well to join our community of supportive women where we support each other at whatever stage we are in our ventures, in whatever way necessary. Join My Blooming Biz Power Circle here.

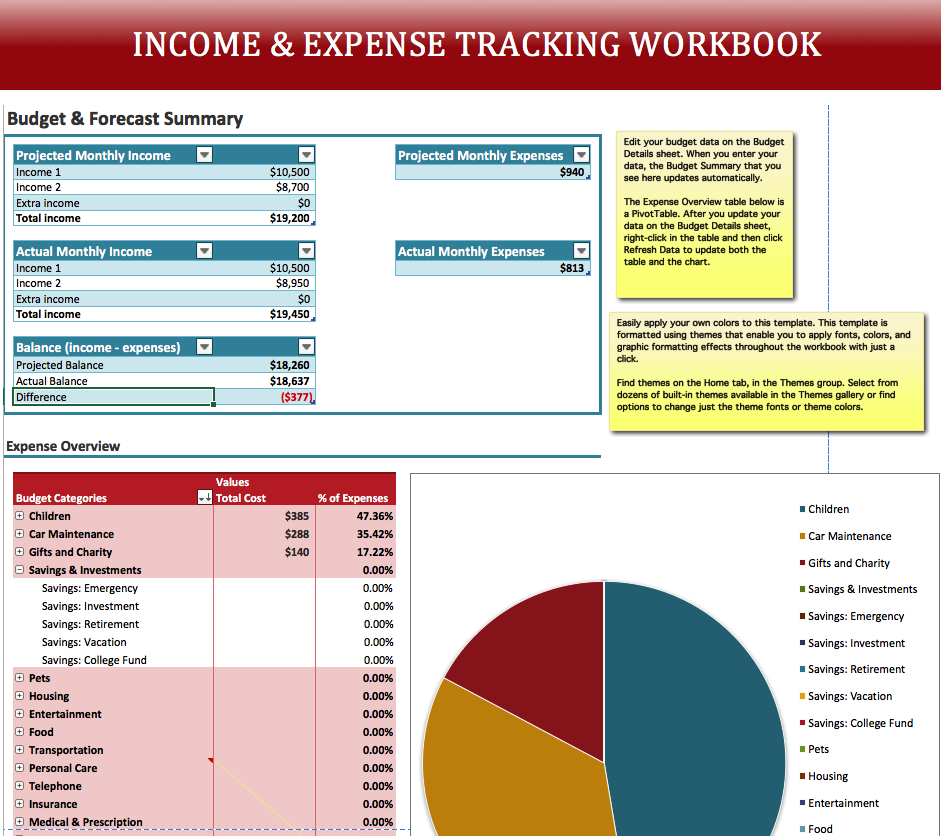

At the very least, a system should be put in place to track your income and expenses. But more than that, you should also have a budget which is a guideline you set - based on what you earn - as to how much you can spend on what over a period of time. Typically, a monthly budget will suffice but you need to add a forecast so you can better plan ahead.

What's the point in putting in the time and effort to make all that money if you're not going to manage it and ensure every bit of it goes ONLY where you want it to go? As my grandpa use to say, "money is hard to earn but easy to spend. It can take years to accumulate but seconds to dissipate." It's pointless, right? Yet, many of us do not manage our money at all.

Whether you have a job or a business, you can manage your money using one of the multiple software that are available and FREE. For your personal use, there is MINT.com, and for your business use there is QuickBooks. Both are created and hosted by Intuit, but there are a lot of other FREE financial tracking software out there. You can also choose to use the good old Spreadsheet. Just saying, there's no excuse not to visually and intentionally track and manage your money.

After you have started tracking and managing your money - if you've not been doing so, you can then start to effectively manage your money. There is a difference, as you will see later on.

As far as debt, the goal is to not get into debt at all, except if it's a good debt such as a mortgage for a rental property. But many people are in (bad) debt, and if you're one of them, your aim should be to become debt free. I, like many of you, have been in debt, and have struggled to find the way out. Thank God I have! And you can too. You can break those chains and be in control of your finances to the point where your money begin working for you instead of you constantly working for money. Yes, your money can work for you! Get this Debt FREE in 5 Steps eBook and begin ridding yourself of your (bad) debt so you can get started on putting your money to work for you.

Here is a video to help you get started on setting up and managing your finances on the FREE platform, Mint.com. If you would rather track it in Microsoft Excel, feel free to download the FREE Income and Expense Tracking Workbook I have put together for you. Bottom line: track and manage your finances.